The call option value is made up of intrinsic value and time value. The intrinsic value is the difference between the stock price and the strike price. So, if a stock is priced at $21 and the strike price is $20, the intrinsic value is $1. When the stock price is higher than the strike price, the option call is said to be in the money. The time value is usually made up of the true time value and the extrinsic value. The true time value diminishes as the call option nears the expiration date. The extrinsic value depends on a bunch of factors, the two most important being the stock price itself and the implied volatility. There are books about how options are valued so I certainly won't delve into it here.

When the option call is in the money, the option value kinda follows the stock price movement. How close the option follows the stock depends upon what is called the delta. The closer the option delta is to 1, the closer the option price follows the stock price. That's a very good thing!

The bad thing about a call option is that you have two things going against you. First, you have time (true time value diminishes exponentially as the expiration date gets closer) to fight against. Second, you have to beat the spread (difference between the bid and the ask). Indeed, you usually buy at the ask price and sell at the bid price and the difference is the spread which never goes into your pocket. The more volatile the stock, the larger the spread.

Let's look at a call option chain to make things more interesting. To get option quotes, it is a good idea to visit the Options Industry Council and enter your favorite stock in the quotes section.

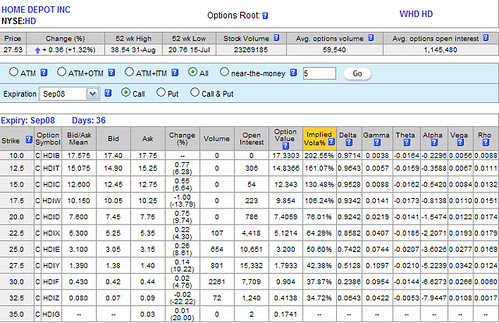

We are looking at the Home Depot (HD) call option chain (just showing the call options expiring in September 08). If you look at the $25 strike price option, you can buy it for 100x$3.15=$315 and it's pretty much like owning 100 shares of that good old HD stock. So instead of spending $2,753 to own 100 shares of HD, you just spend a mere 315 bucks for about the same thing (well, not quite since for one thing, you ain't gonna get any dividends). The volume represents the number of options traded today. The open interest is the number of options that have not yet been closed (in other words, are still open). You can see that the more in the money the option, the higher the delta and the more expensive (because of bigger intrinsic value). The implied volatility kinda tells you if the option is overpriced (high volatility means that the price may move quite a bit and you always pay a premium for that). The option value is computed using some formula where the unknown is the implied volatility, so the two kinda depend upon each other. It's put in there to help you decide whether the option is undervalued or overvalued (or just right).

In short-term trading, it is not recommended (although quite tempting) to buy out of the money options. Concerning the expiration date, it is a good idea to buy options that do not expire in the month during which you are planning to buy (the following month should be fine).

No comments:

Post a Comment