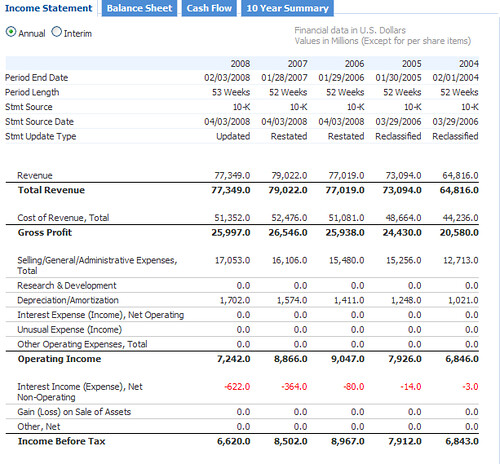

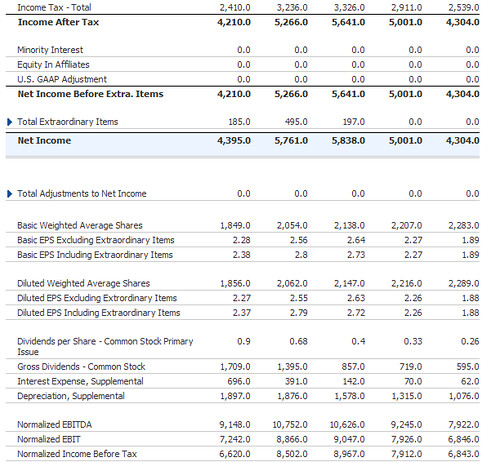

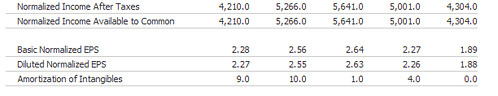

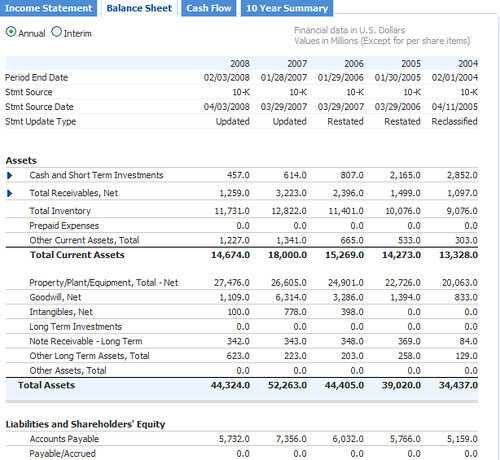

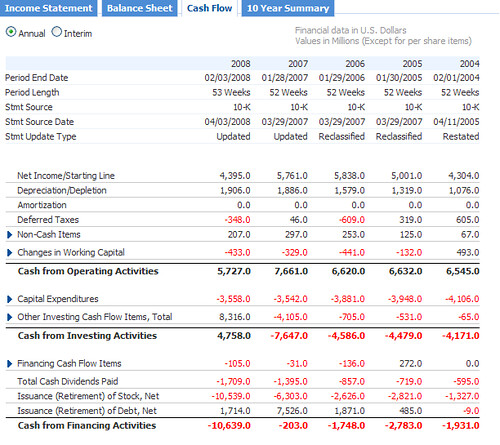

We are gonna be looking at the income statement, balance sheet and cash flow for HD that are available at MSN Money (go to "financial results" and then "statements" after having entered the stock name in the quotes window). Here they are (the analysis will follow):

Now that the graphics are out of the way, let's crunch some numbers!

Profitability

1. Net Income. The net income is 4,395.0. One point awarded.

2. Operating Cash Flow. It is also known as the net cash from operating activities. The operating cash flow is 5,727.0. One point awarded.

3. Return on Assets (net income divided by total assets). In 2008, the net income is 4,395.0 and the total assets are 44,324.0 for a ROA of 9.9%. In 2007, the net income was 5,761.0 and the total assets were 52,263.0 for a ROA of 11.0%. No point awarded.

4. Quality of Earnings. The net income is 4,395.0 and the operating cash flow is 5,727.0. One point awarded.

Debt and Capital

5. Total liabilities to Total Assets ratio. In 2008, the total liabilities are 26,610.0 and the total assets are 44,324.0 for a TL/A ratio of 60.0%. In 2007, the total liabilities were 27,233.0 and the total assets were 52,263.0 for a TL/A ratio of 52.1%. No point awarded.

6. Working Capital (current assets minus current liabilities). In 2008, the working capital is 14,674.0 (current assets) minus 12,706.0 (current liabilities), that is, 1,968.0. In 2007, it was 5,069.9. No point awarded.

7. Shares Outstanding. In 2008, the number of shares outstanding is 1,690.0. In 2007, it was 1,970.0. If you add 2% to the 2007 figure, you get 2,009.4. One point awarded.

Operating Efficiency

8. Gross Margin (gross income divided by sales). In 2008, the gross margin is 25,997.0 (gross profit) divided by 77,349.0 (sales), that is, 33.6%. In 2007, the gross margin was 26,546.0/79,022.0=33.6%. No point awarded since it has stayed the same (although one could argue I suppose).

9. Asset Turnover (revenues divided by total assets). In 2008, the asset turnover is 77,349.0/44,324.0=174.5%. In 2007, the asset turnover is 79,022.0/52,263.0=151.2%. One point awarded.

Added Tests

10. Total liabilities to EBITDA (earnings before interest, taxes, depreciation and amortization) ratio. The total liabilities are 26,610.0 and the EBITDA is 9,148.0 for a ratio of 2.9. One point awarded.

11. Total Liabilities to Operating Cash Flow ratio. The total liabilities are 26,610.0 and the operating cash flow is 5,727.0 for a ratio of 4.6. One point awarded.

When the points are tallied, you get a total of 7 points for the home improvement store. Conclusion: Home Depot passes the financial strength test (for high debtors)!

No comments:

Post a Comment